Review Your Credit Score and History

Your credit score plays a major role in mortgage qualification. Before applying, review your credit report to ensure accuracy and identify any issues. A strong credit score can improve your loan options, interest rates, and approval eligibility.

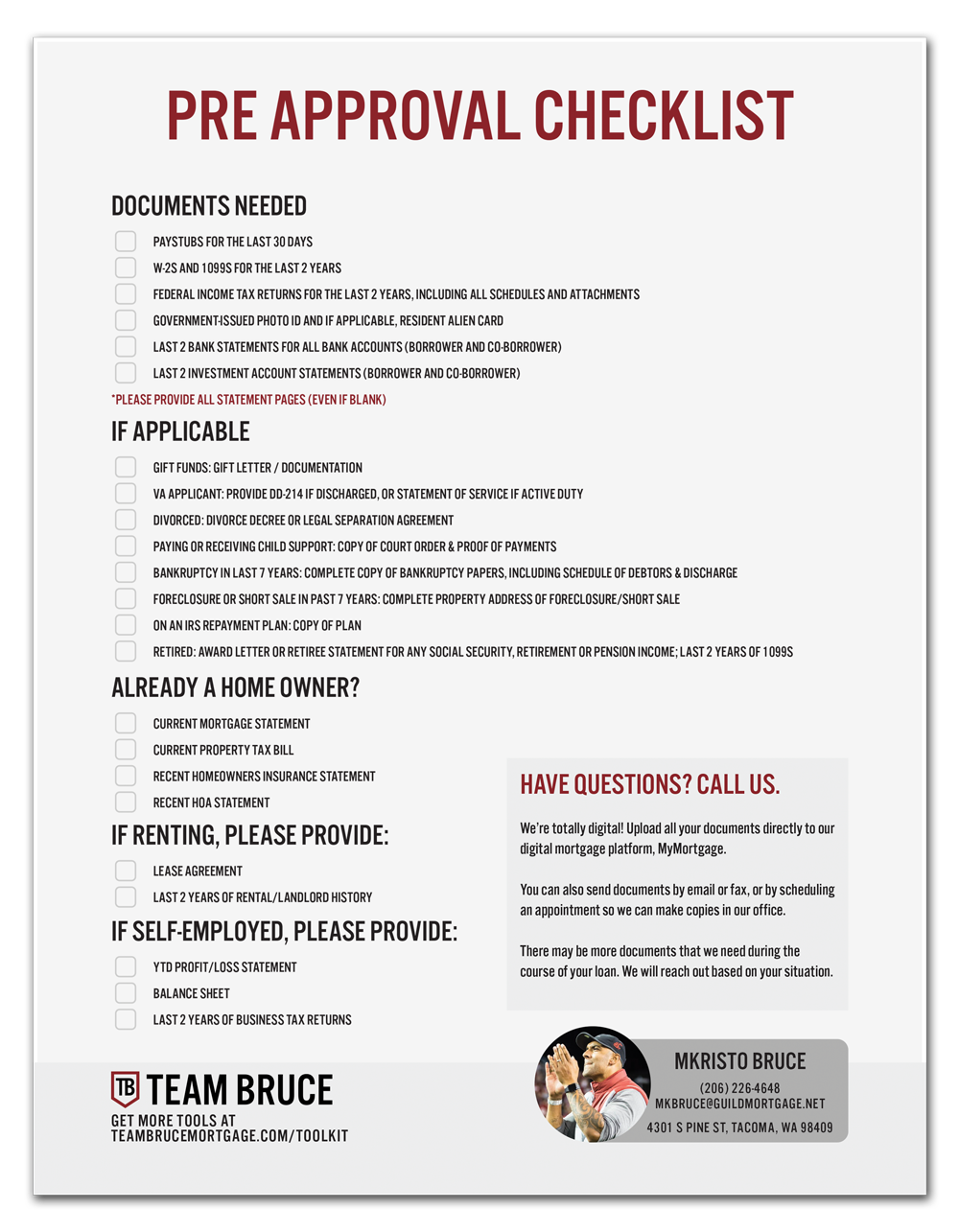

Gather Proof of Income

Lenders require evidence of stable income. Prepare documents such as recent pay stubs, bank statements, tax returns, or business financials if you are self-employed. Clear income records help lenders evaluate your ability to manage monthly payments.

Organize Asset and Savings Documents

Assets help demonstrate financial stability. Gather records of savings accounts, investment accounts, retirement funds, or any other financial resources. These documents help verify your ability to cover a down payment, closing costs, and reserves.

Understand Operating Expenses

Factor in all operating costs, including property taxes, insurance, maintenance, property management fees, utilities, and vacancy allowances. Accurately calculating expenses provides a clearer picture of the property’s true profitability.

Prepare Information on Debts and Obligations

Lenders evaluate your debt-to-income ratio to determine how much you can safely borrow. Make a list of existing debts such as credit cards, student loans, auto loans, or personal loans. Transparency helps lenders calculate accurate loan approval amounts.

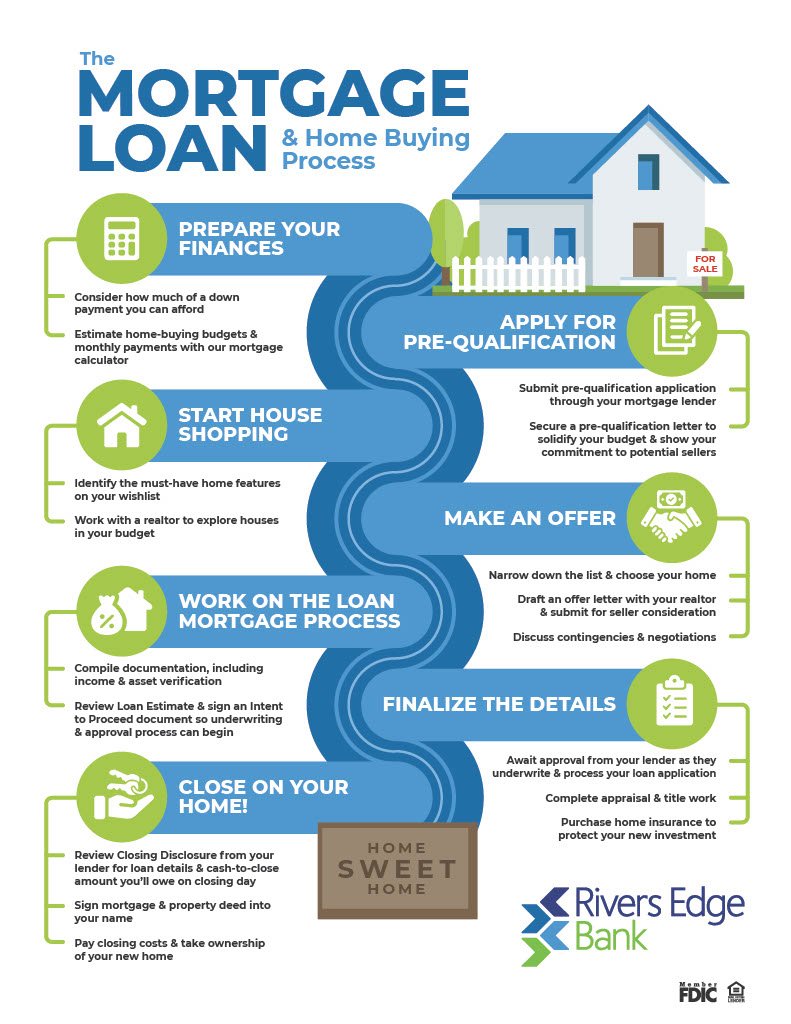

Determine Your Budget and Down Payment Plan

Understanding how much you want to spend—and how much you can comfortably afford—helps guide the loan approval process. Establish a down payment plan and consider additional costs such as insurance, taxes, and monthly utilities.

Compare Lenders and Loan Options

Different lenders offer different rates, terms, and loan programs. Research mortgage companies, review interest rates, and compare qualification requirements. Choosing the right lender can improve both affordability and long-term financial comfort.

Join The Discussion