Market Demand and Vacancy Trends

Investigate neighbourhood demand, rental absorption, and vacancy levels. Strong demand reduces downtime and helps maintain consistent rental income.

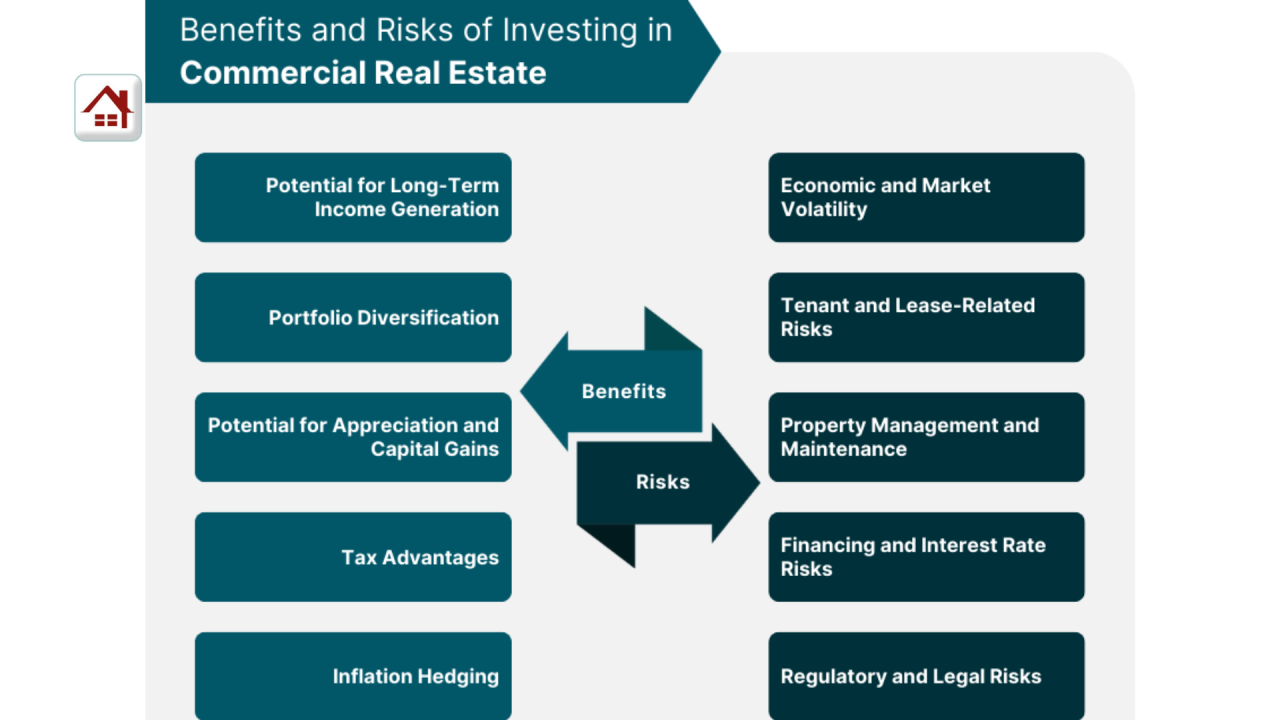

Tenant and Income Stability

Evaluate potential tenant base, employment conditions, and income profiles. Stable tenant markets reduce turnover risk and protect monthly cash flow.

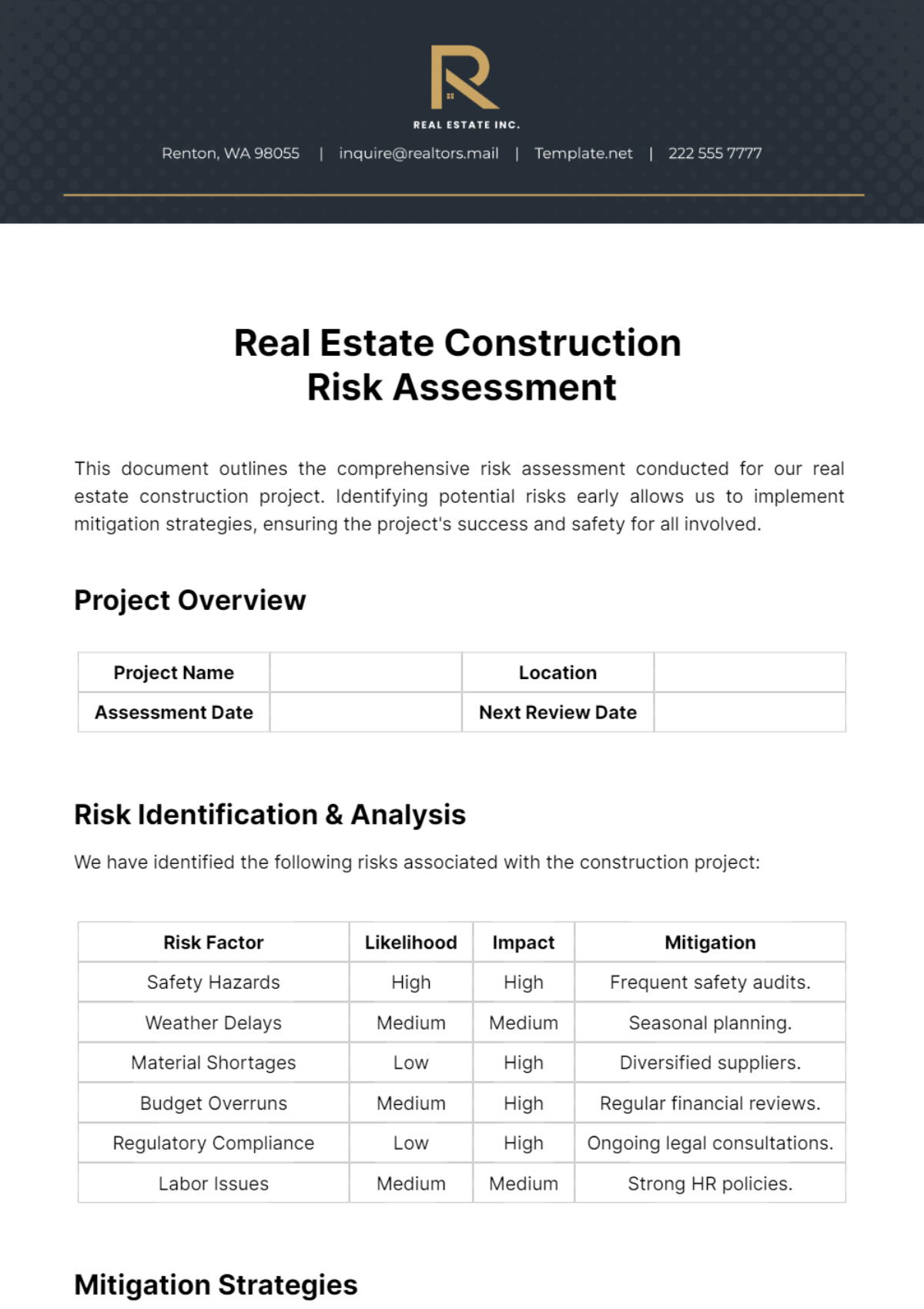

Property Condition and Repair Exposure

Assess structural condition, plumbing, electrical systems, roofing, and safety. Deferred maintenance increases unexpected costs and reduces net income.

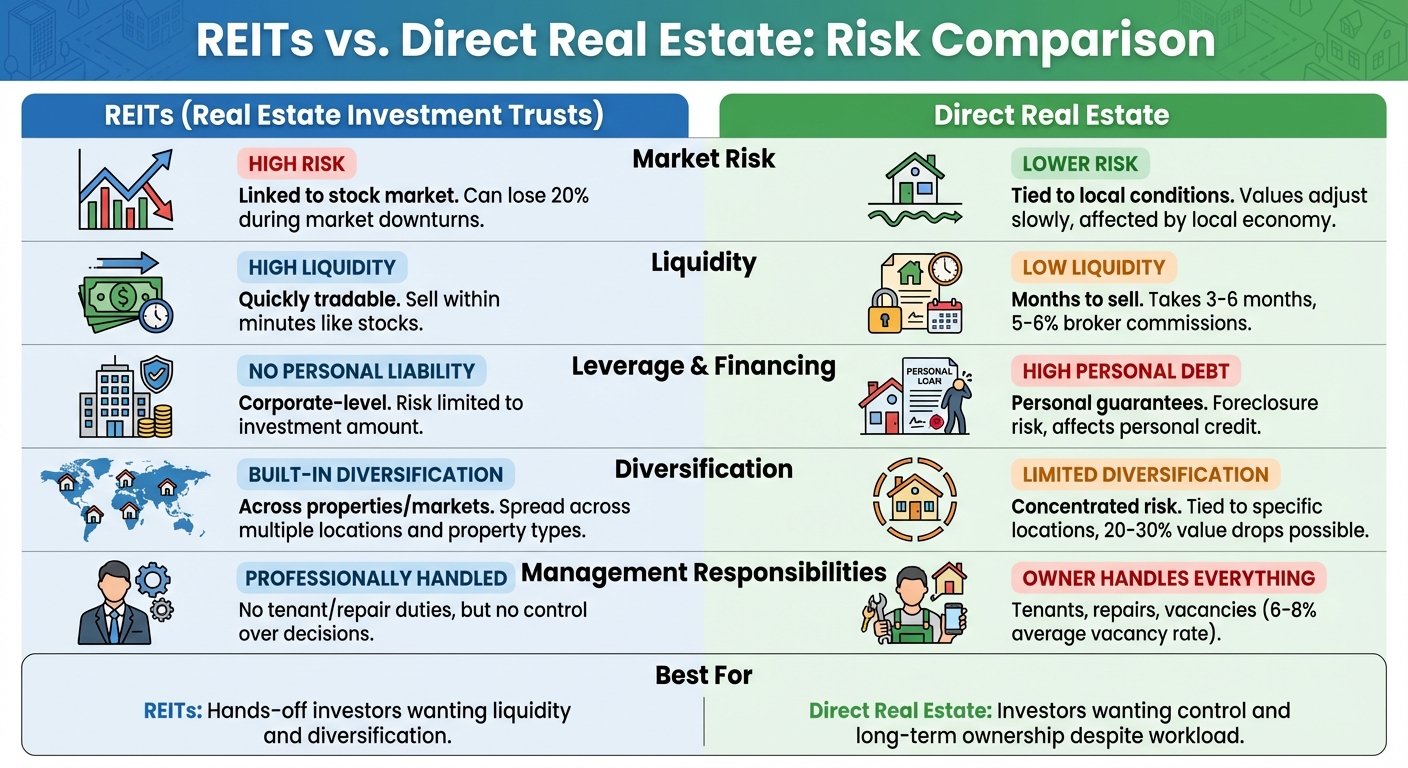

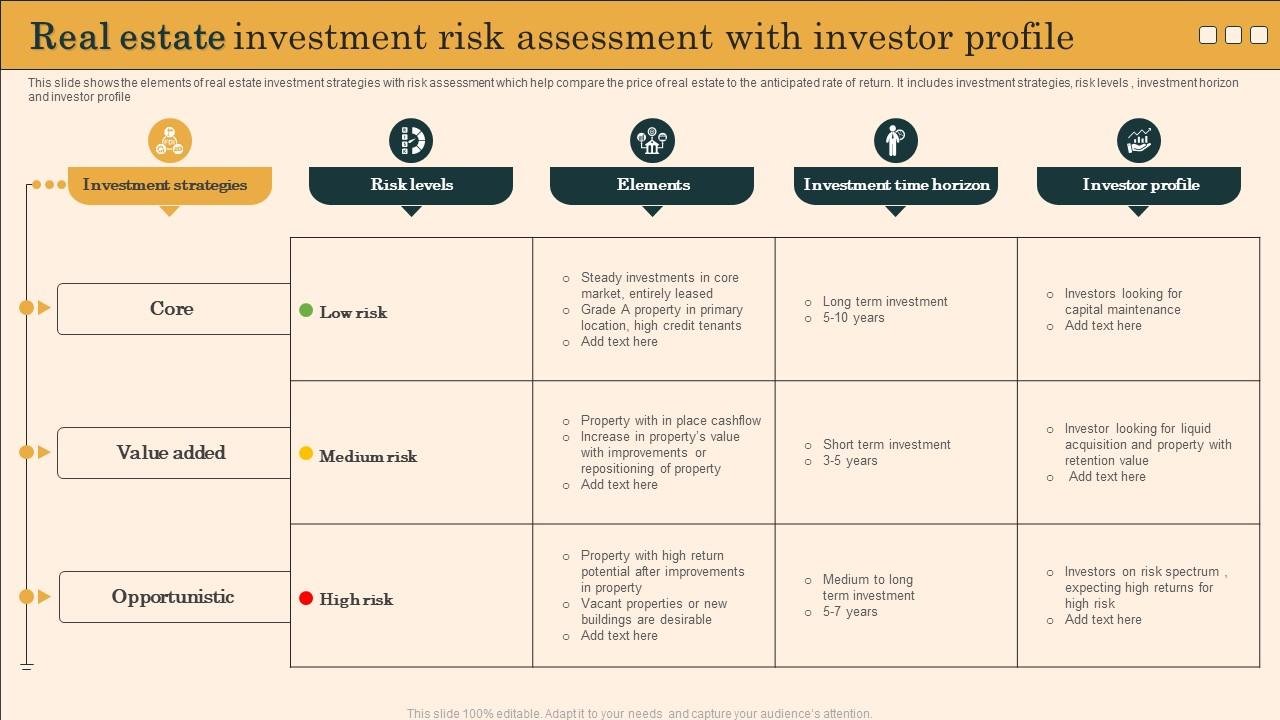

Financing Terms and Interest Sensitivity

Review loan structures, interest rate exposure, and repayment terms. Flexible financing supports stability; aggressive leverage increases downside risk.

Cash-Flow and Expense Reserves

Unexpected vacancies, repairs, or legal needs require short-term reserves. Investors should budget realistic operating costs, not ideal outcomes.

Regulatory and Compliance Considerations

Local rules, zoning limits, rental restrictions, or tax changes influence returns. Understanding compliance reduces legal exposure.

Exit Strategy Options

A property should support resale, refinancing, or rental flexibility. Multiple exits reduce risk and allow investors to shift strategy as markets change.

Join The Discussion