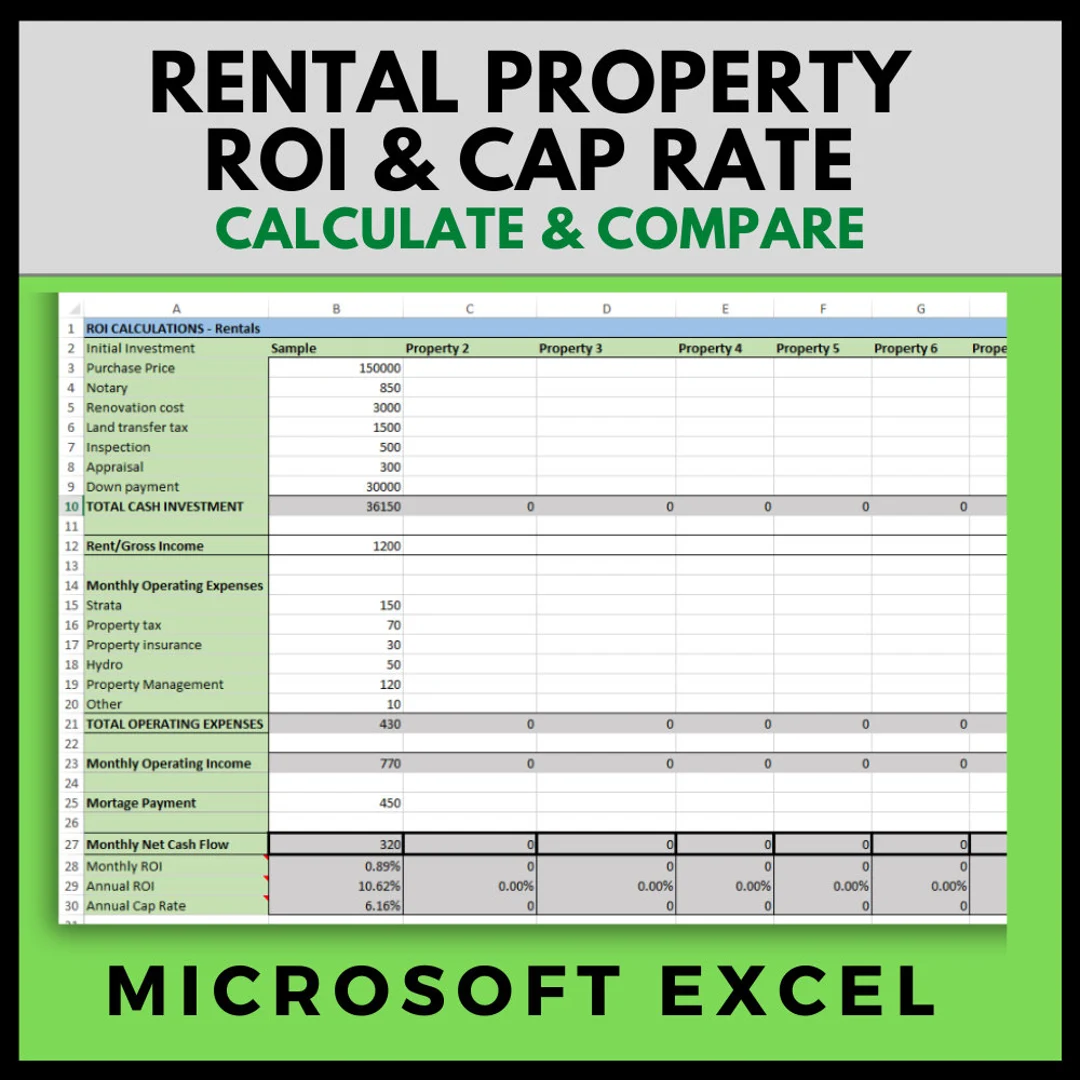

ROI Measures Overall return vs. Cost

ROI helps investors understand how much profit they earn compared to what they spent. It reflects the gain after expenses, renovations, or holding costs. Higher ROI indicates stronger financial performance over time.

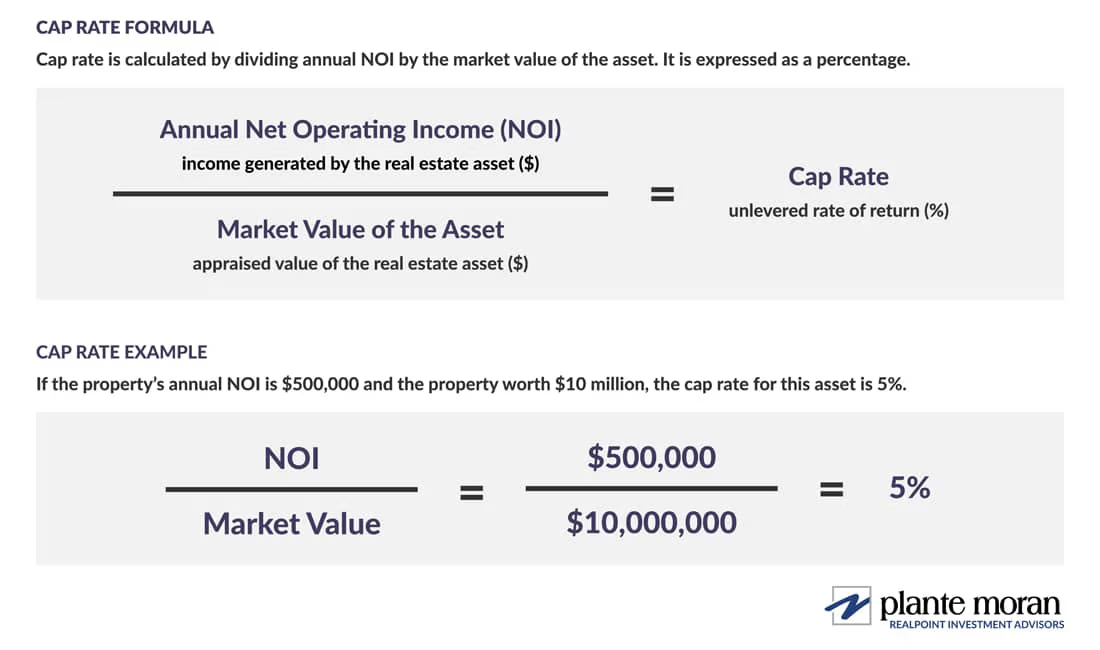

Cap Rate Focuses on Income vs. Property Value

Cap Rate shows how much annual income a property generates before financing costs. It compares Net Operating Income (NOI) to property value, helping investors compare different assets quickly and objectively.

Strong ROI Requires Tracking Expenses

Maintenance, taxes, insurance, vacancy, and management fees affect performance. Investors should calculate realistic operating costs to understand true profitability—not just rental income.

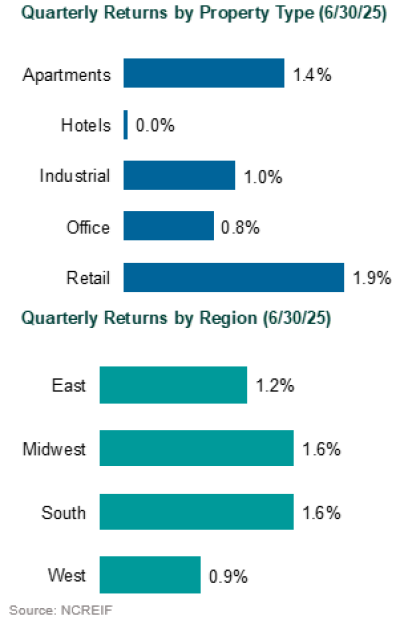

Cap Rates Vary by Market and Risk

Higher cap rates may reflect higher risk or less desirable locations. Lower cap rates often occur in stable markets with strong demand. Investors should evaluate local trends, demand, and tenant strength.

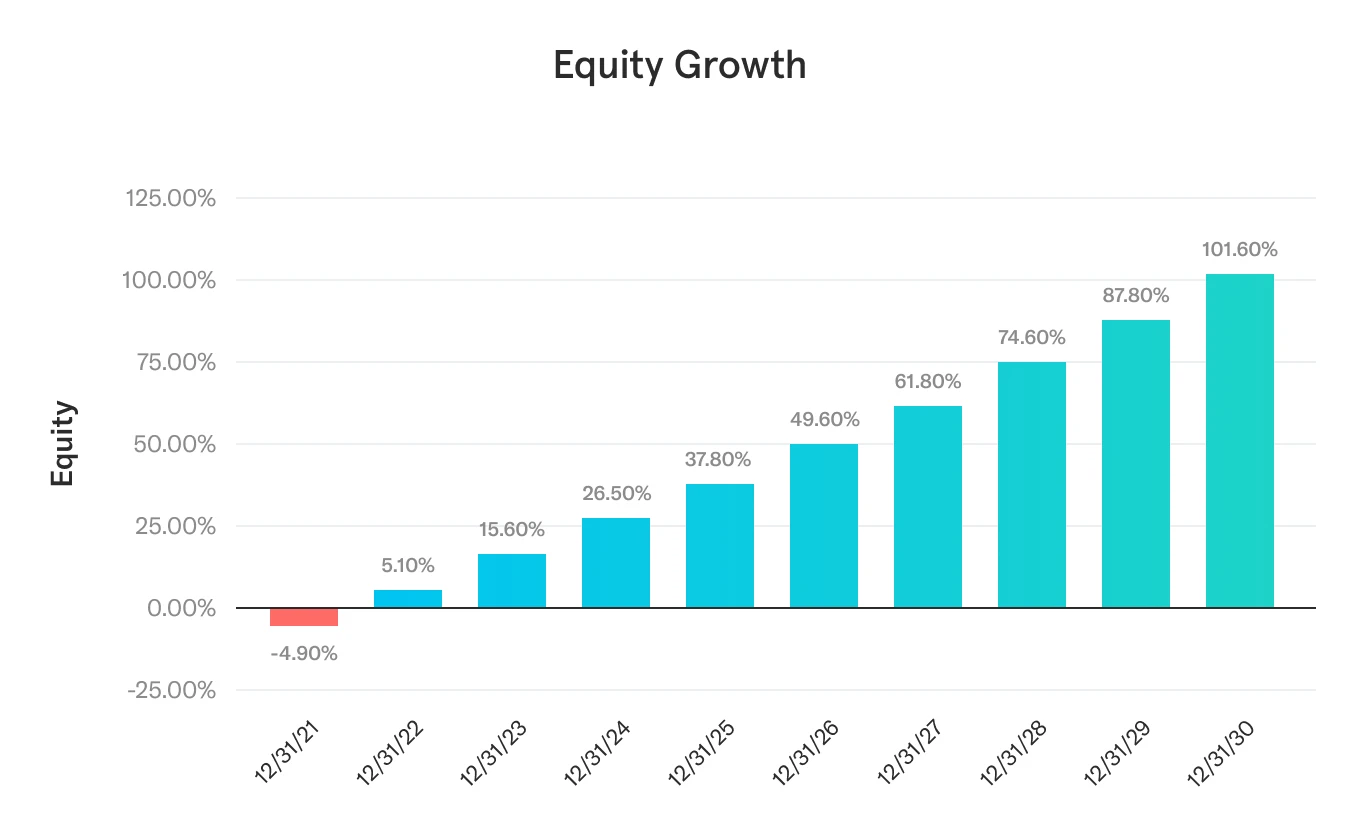

ROI Helps Assess Renovation Value

Upgrades are profitable only if returns exceed expenses. Investors should compare renovation cost vs. future rent increase or resale value. Smart improvements increase asset competitiveness.

Cap Rate Supports Long-Term Comparisons

Cap rate helps evaluate similar rental properties across markets. It allows investors to benchmark performance and understand how local pricing affects income strength.

Both Metrics Guide Smarter Purchases

ROI helps evaluate total return; Cap Rate helps evaluate income efficiency. Together, they create a balanced view—preventing overpaying and supporting long-term investment discipline.

Join The Discussion