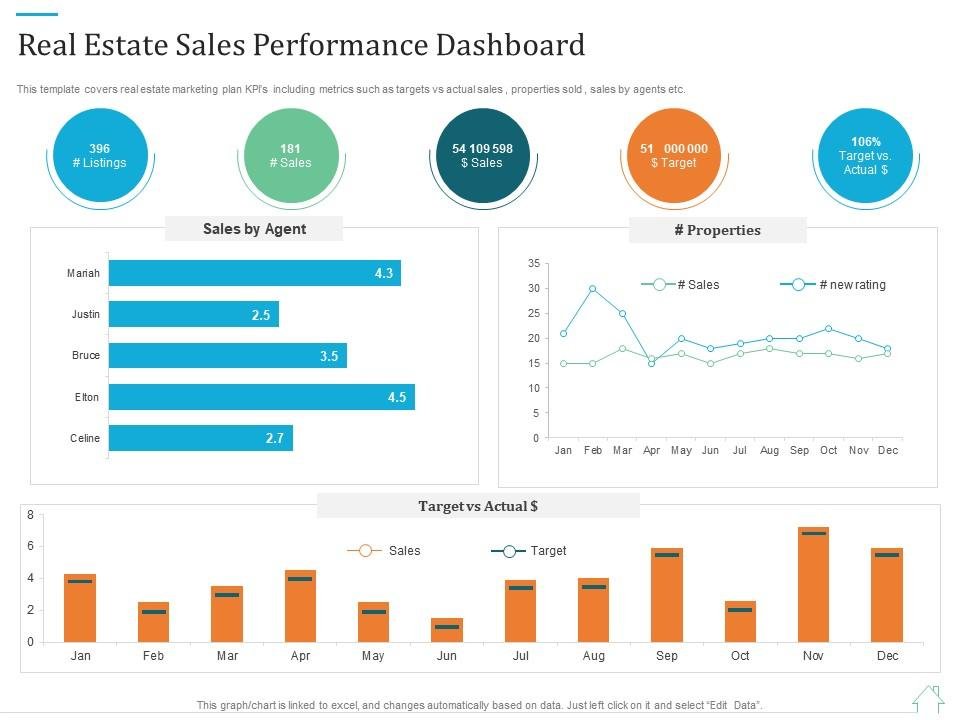

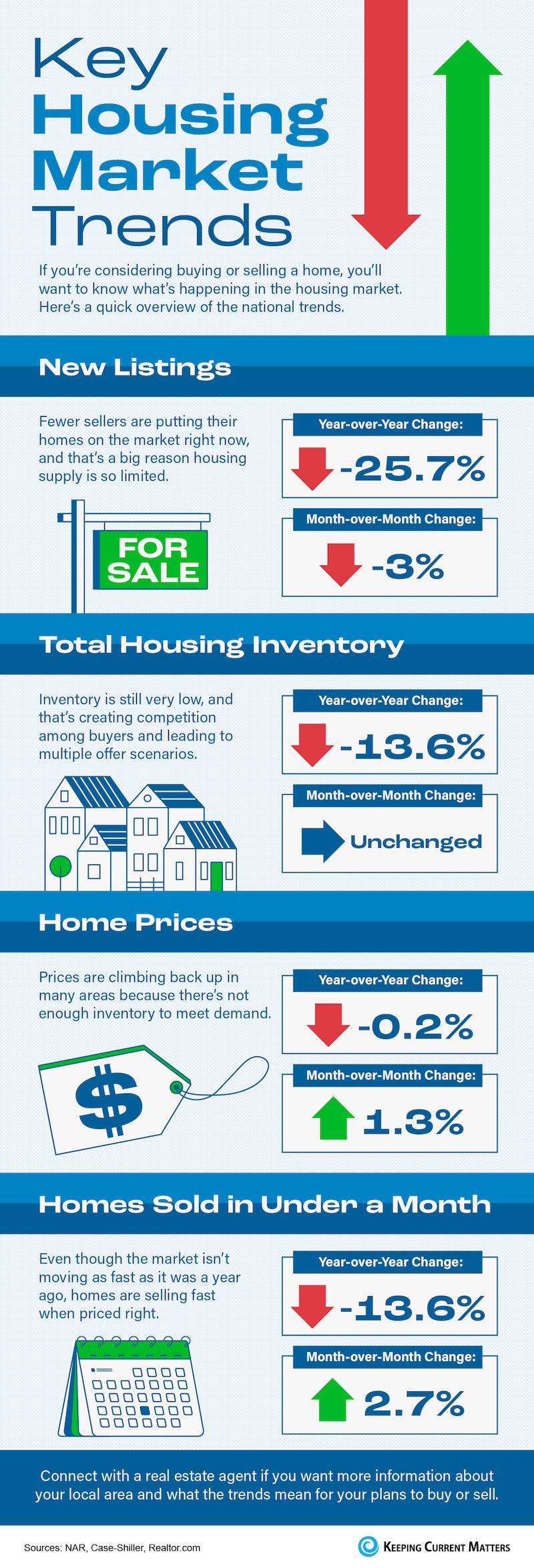

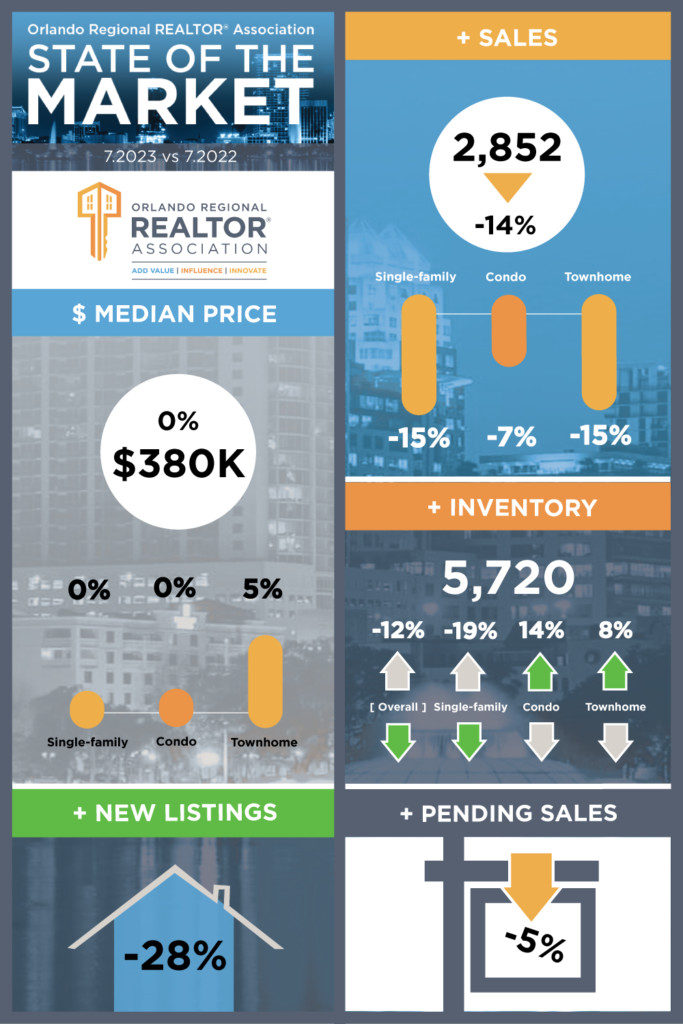

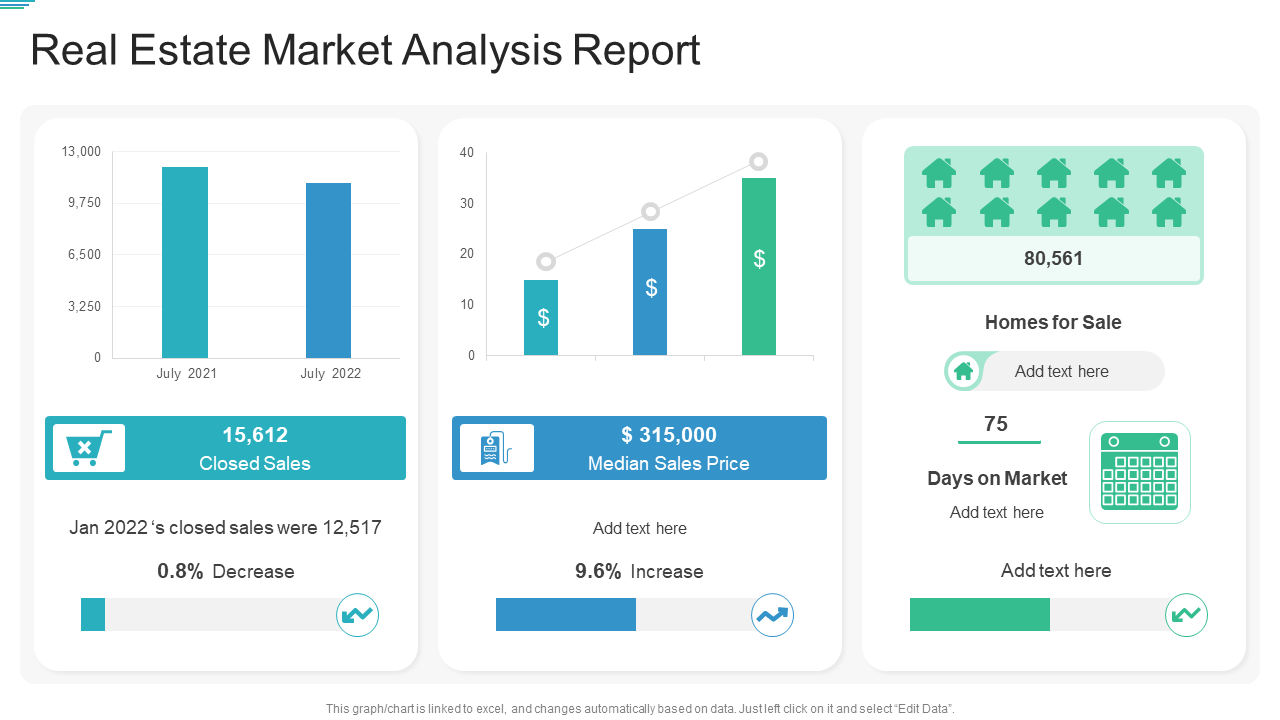

Track Pricing Trends and Sales Activity

Review recent sales, average days on market, and price movement. Rising demand indicates strength; declining prices may signal oversupply or slower absorption.

Evaluate Rental Performance and Demand

Investigate vacancy levels, rental rates, and tenant profiles. Strong rental stability supports predictable income and reduces turnover uncertainty.

Study Economic and Employment Factors

Job growth, major employers, and business expansion influence housing needs. Areas with economic momentum often offer stronger long-term appreciation.

Examine Development and Infrastructure Plans

Upcoming transport, schools, retail, and zoning changes affect future desirability. Infrastructure investment can shift property values and rental demand quickly.

Understand Neighbourhood Demographics

Population growth, income trends, and household size reflect purchasing power. A stable resident base helps protect occupancy levels.

Review Regulatory and Tax Conditions

Rental laws, investor restrictions, licensing regulations, and property taxes affect profitability. Understanding compliance upfront prevents legal or financial surprises.

Compare Market Risk vs. Return Potential

No market is risk-free. Investors should balance appreciation expectations, cash-flow strength, and volatility tolerance. A balanced approach maintains portfolio health.

Join The Discussion