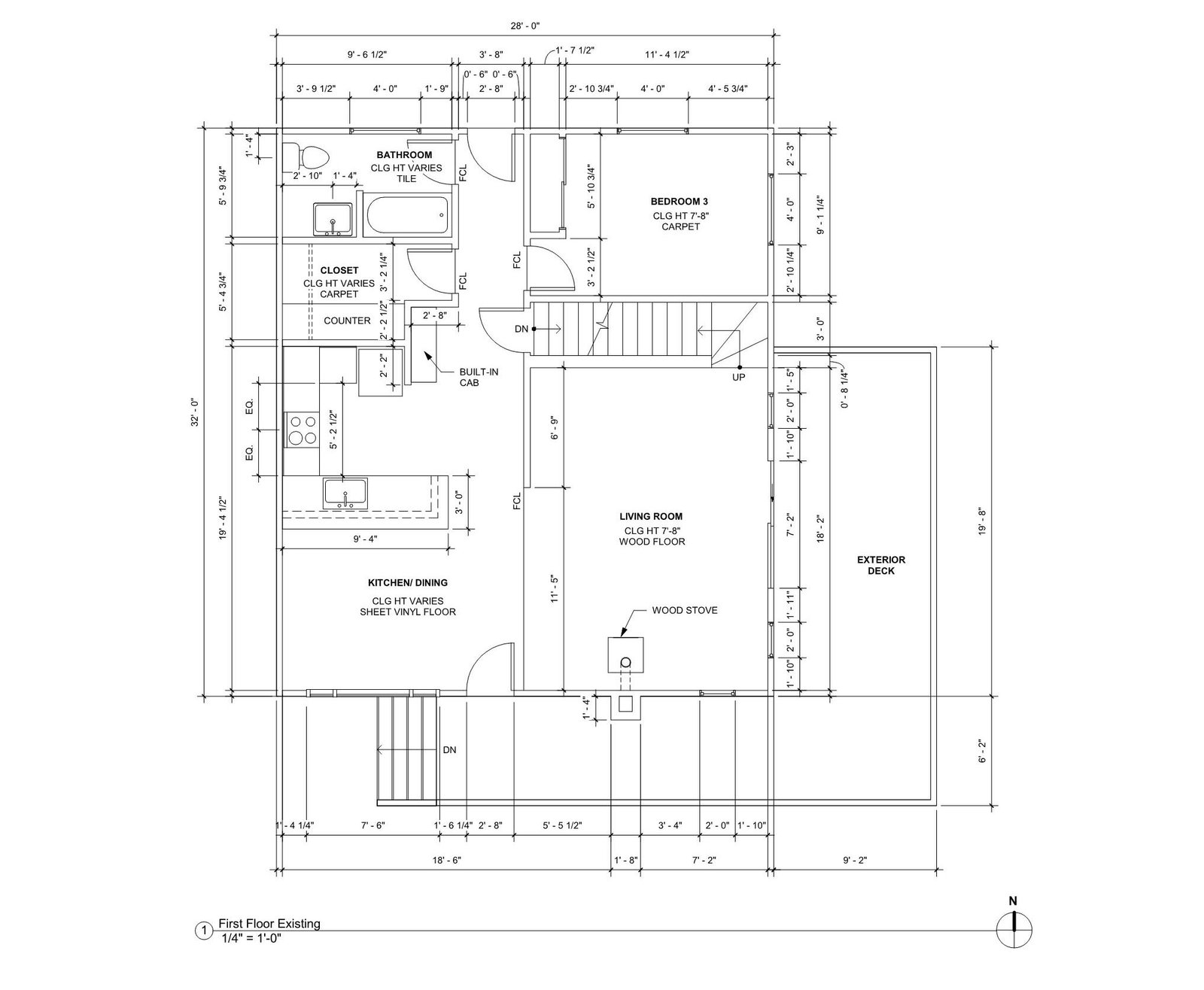

Start With Market-Driven Needs

Every neighbourhood has different expectations. Renovations should reflect local demand—functional layouts, safe infrastructure, clean finishes, and modern basics. Market alignment prevents wasted spending.

Separate Essential Repairs From Value-Add Upgrades

Structural fixes, electrical work, plumbing, and safety improvements come first. Only after essentials are secured should investors add features like kitchen updates, bathroom finishes, or flooring upgrades.

Focus on High-Impact Spaces

Kitchens, bathrooms, and flooring influence rental pricing and buyer perception the most. Small improvements—hardware, lighting, repainting, counters—often deliver strong returns without full replacement.

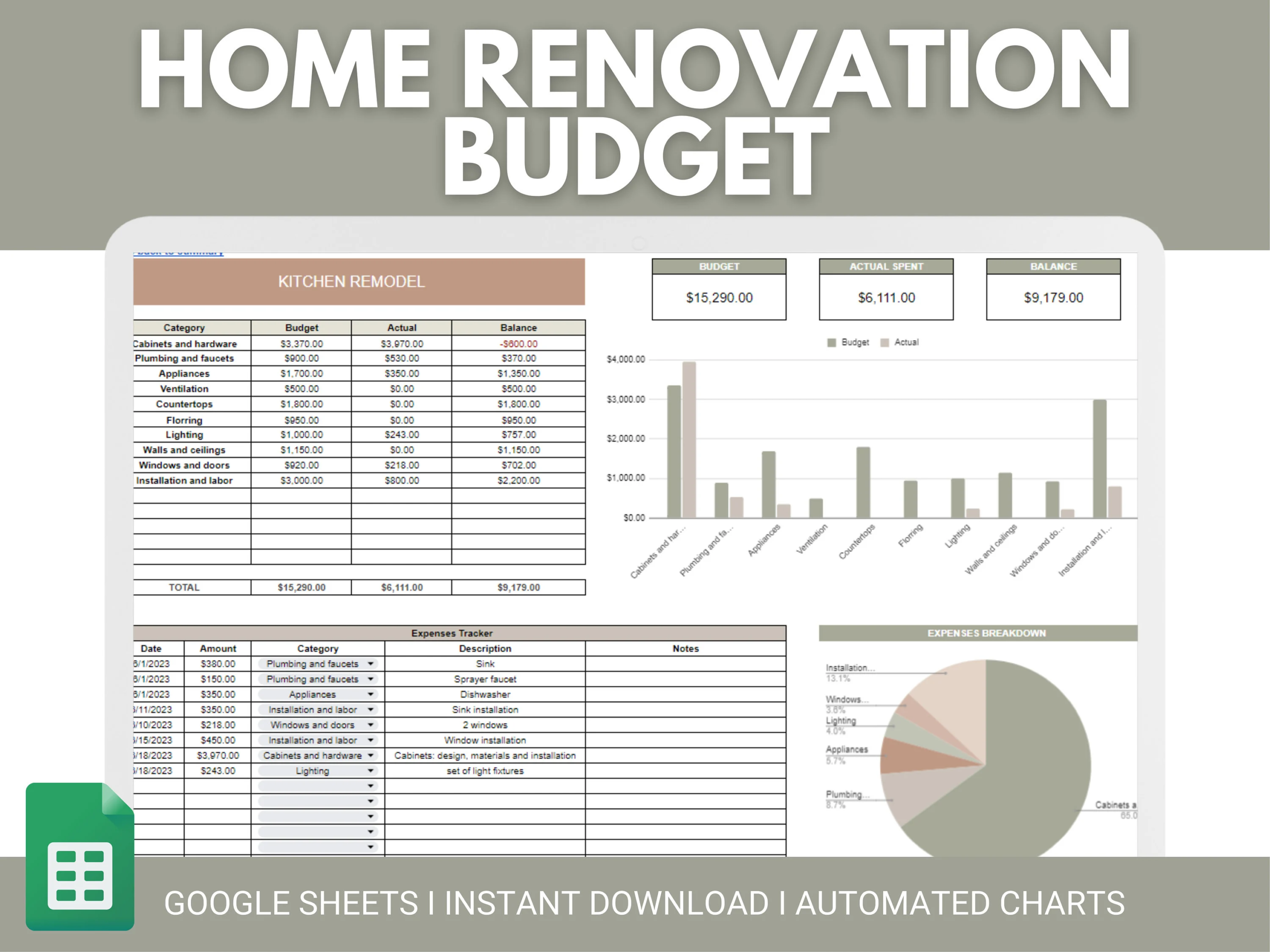

Evaluate Cost vs. Income Potential

Before committing to upgrades, compare total cost with expected rent increase or resale gain. The best renovations recover investment quickly and increase long-term yield.

Standardize Materials and Finishes

Using durable, neutral, and easy-to-replace materials keeps maintenance affordable. Standard finishes simplify repairs for rental turnover and create a consistent brand across properties.

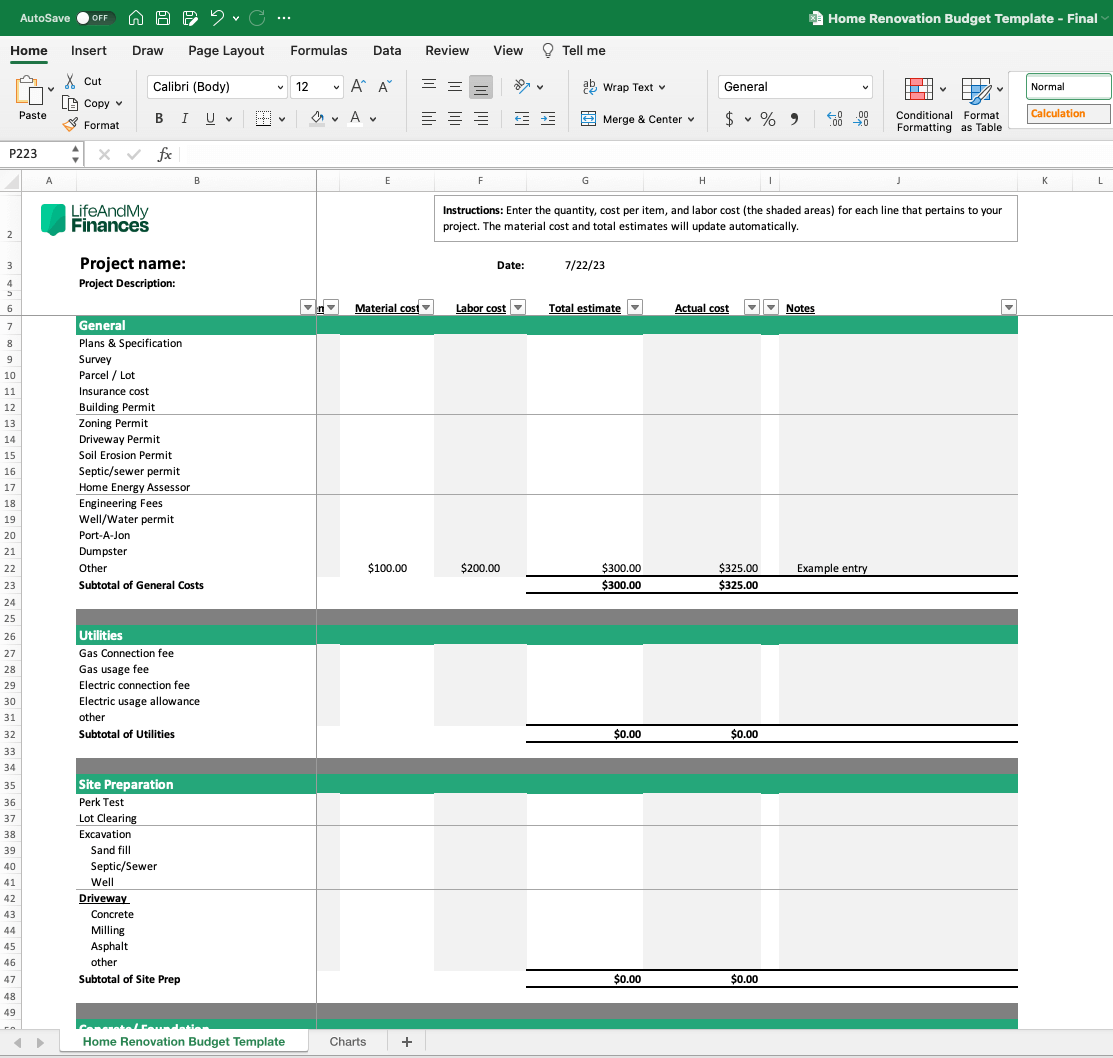

Track Renovation Timelines

Delays increase holding costs and reduce rental income. Investors benefit from project schedules, contractor oversight, and realistic timelines to protect profitability.

Review Performance After Completion

Once upgrades are complete, monitor vacancy changes, rent performance, and tenant satisfaction. Ongoing review helps investors refine future renovation planning.

Join The Discussion