Overestimating What You Can Afford

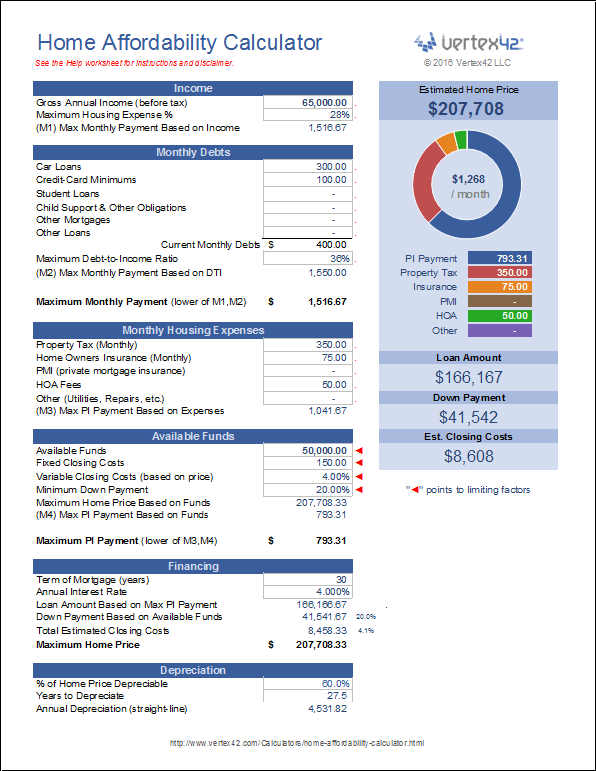

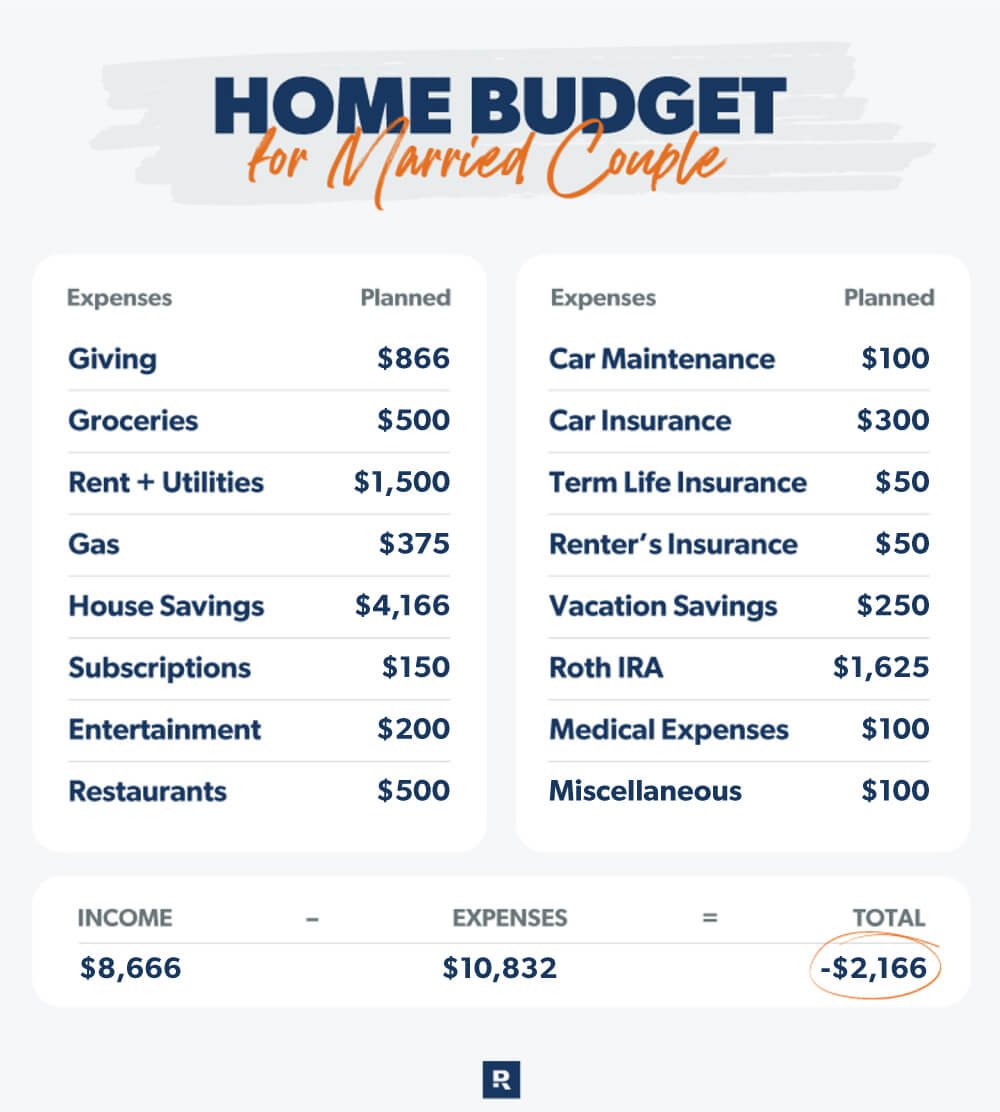

One of the most common mistakes is budgeting based on ideal scenarios instead of realistic numbers. Buyers sometimes focus only on the mortgage payment and overlook expenses such as taxes, insurance, utilities, and maintenance. A practical budget should fit comfortably into your lifestyle—not stretch it.

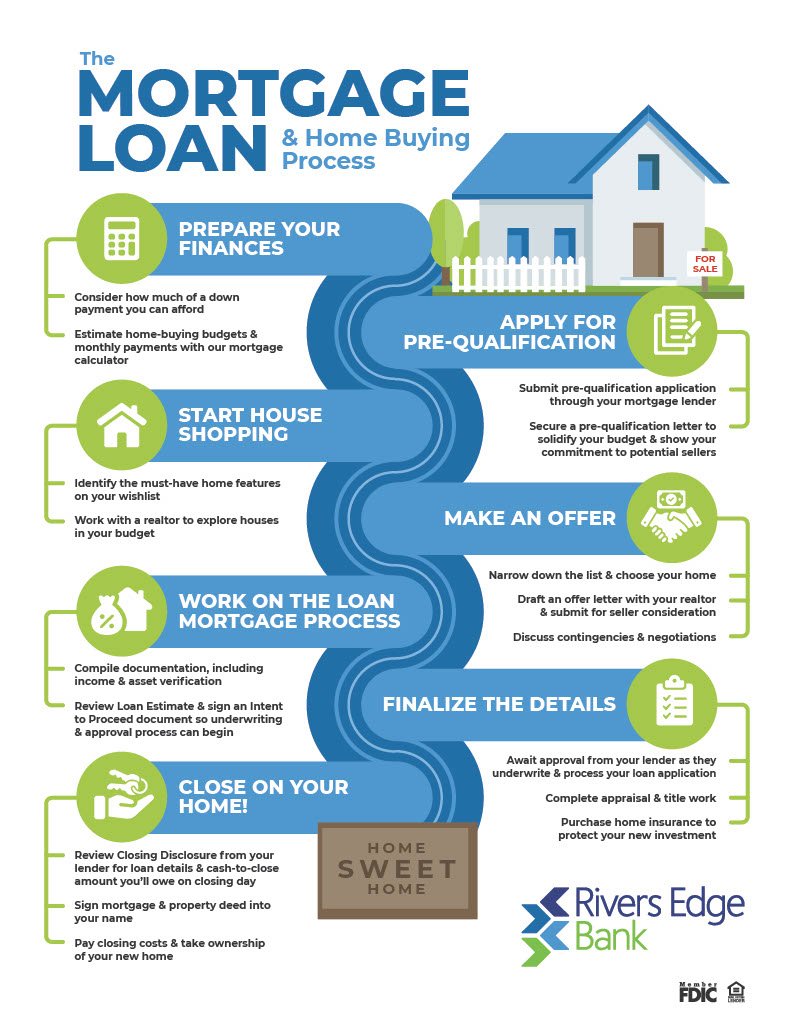

Forgetting About Upfront and Closing Costs

Many buyers plan for a down payment but forget about additional expenses needed for closing. Costs may include inspections, appraisals, title fees, attorney fees, and loan charges. Preparing for these expenses prevents last-minute surprises and helps your purchase move smoothly.

Skipping Credit Review and Financial Clean-Up

Your credit score affects loan eligibility and interest rates. Some buyers apply for a mortgage without reviewing their credit history or correcting errors. Improving credit before applying can lower borrowing costs and increase approval options.

Taking on New Debt During the Loan Process

Financial stability matters throughout the approval stage. Opening new credit lines, financing a vehicle, or increasing credit card balances can affect your debt-to-income ratio. Avoid major financial changes until after closing to protect loan approval.

Not Comparing Lenders or Loan Programs

Different lenders offer different rates, terms, and qualification requirements. Accepting the first offer may cost more long term. Reviewing multiple loan options ensures you choose the structure that works best for your financial goals.

Ignoring Rate Locks and Market Changes

Interest rates can fluctuate. Some buyers wait too long to lock a rate, which may increase future payments. Understanding when to secure financing helps maintain predictability and supports long-term affordability.

Leaving No Financial Cushion After Buying

A common oversight is spending all savings on a home purchase. Keeping emergency reserves protects you from unexpected repairs, income changes, or market shifts. A responsible cushion supports long-term financial comfort.

Join The Discussion